california renters credit turbotax

I am a college student filing independent. Federal law lacks a credit comparable to the states Renters Credit.

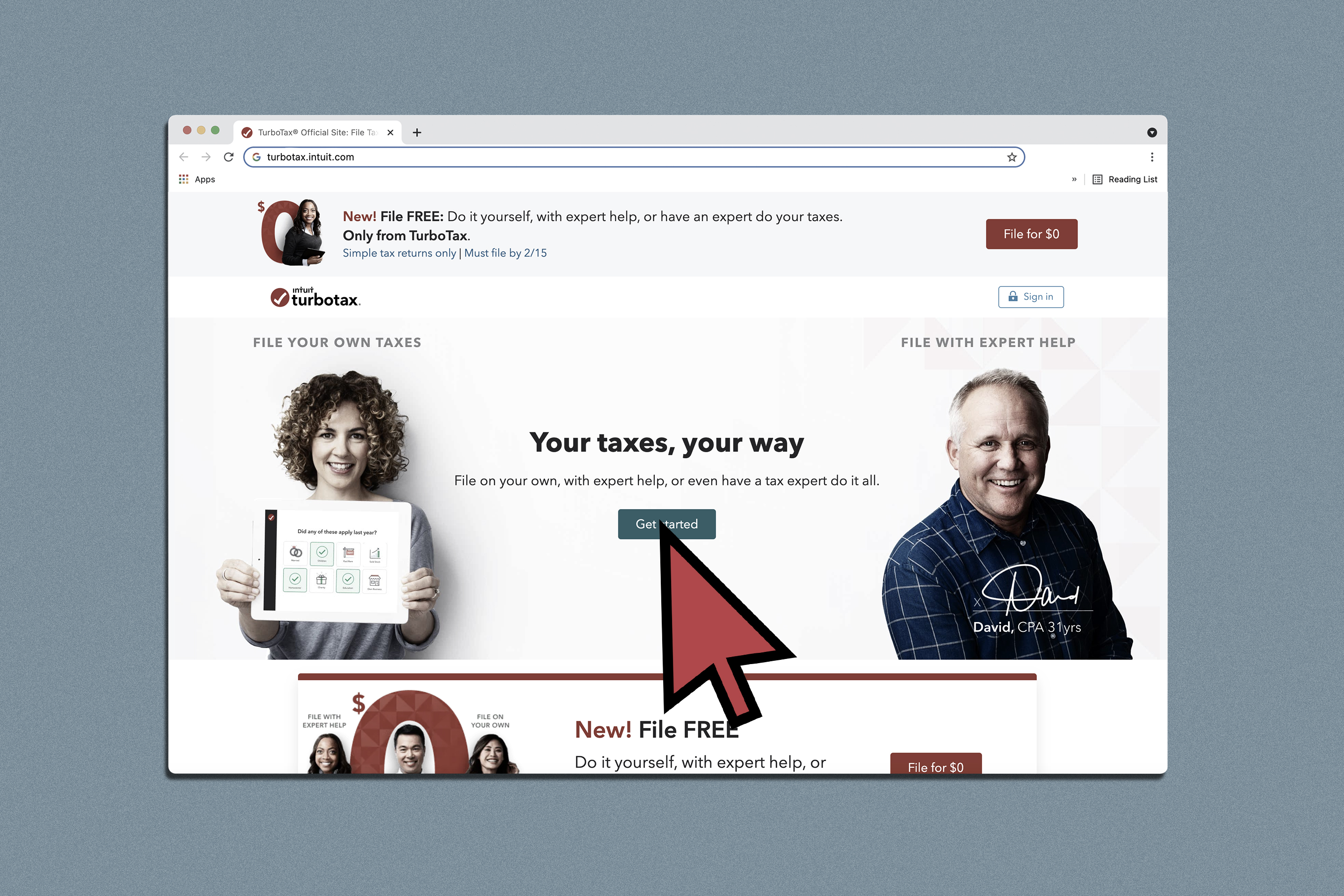

How To File Taxes For Free Turbotax 2022 Free File Change Money

The legislation SB 843 would increase the California.

. For more information on Manitobas Education Property Tax Credit see the following links. Each state has its own regulations around a renters tax credit. Widower How to claim.

Check the box Qualified renter. Or on the screen Take a look at California credits and taxes there is a Renters Credit item listed there. I was also pleasantly surprised that they give you the option to import the TurboTax file from.

The 2019 earnings limits are 42932 single and 85864 married. FreeTaxUsa was great and you can import TurboTax details. If you live in Hawaii and earn less than 30000 per year but pay 1000 or more in rent for your principal residence you may.

For Single filer it is 60. A tax credit is a dollar-for-dollar reduction of the income tax you owe. Kristina Brewer Dec 24 2019.

In California renters who pay rent for at least half the year and make less than a certain amount currently 43533 for single filers and 87066 for married filers may be eligible for a tax credit of 60 or 120 respectively. Renters earning less than 43533 a year are eligible for a 60 tax credit and renters earning less than 87066 a year who are married. Some credits such as the earned income credit are refundable which means that you still receive the full amount of the credit even if the credit.

You can just run through TTCalif again to access the Renters Credit screens. SACRAMENTO Low-income California renters who have been drowning in unaffordable housing costs would see much-needed relief under a bill unveiled Wednesday by State Senator Steve Glazer D-Contra Costa and co-authors representing more than one-third of the Legislature. 60 credit if you are.

June 4 2019 338 PM. California Gives Renters a Tax Credit. California Resident Income Tax Return Form 540 line 46.

Current state law allows a nonrefundable credit for qualified renters in the following amounts for tax year 2017. For example if you owe 1000 in federal taxes but are eligible for a 1000 tax credit your net liability drops to zero. Exempt property includes most government-owned buildings church-owned parsonages college dormitories and military barracks.

Renters Credit on TurboTax Did you pay rent for at least half of 2019 on property in California that was your principal residence is what they asked. Lacerte will determine the amount of credit based on the tax return information. California Renters Credit SOLVED by Intuit Lacerte Tax 11 Updated August 20 2021 Use Screen 53013 California Other Credits to enter information for the Renters credit.

You received the California Earned Income Tax Credit CalEITC on your your 2020 tax return. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition. Some people said TurboTax hand holds you a bit better but FreeTaxUsa was just as easy and thorough.

60 for single or married filing separately with an adjusted gross income AGI of 40078 or less and. Renters in California may qualify for up to 120 in tax credits. In California renters who make less than a certain amount currently 41641 for single filers and 83282 for married filers may be eligible for a tax credit of 60.

Use one of the following forms when filing. That being said each state has its own unique set of rules and we get into these specifics below. Wednesday January 12 2022.

If you are Married Filing Joint the credit is 120. You must be a California resident for the tax year youre claiming the renters credit. TurboTax will ask you the qualifying questions determine if you.

The other eligibility requirements are as follows. In the California interview look for the section called Renters Credit. Renters earning less than 43533 a year are eligible for a 60 tax credit and renters earning less than 87066 a year who are married.

I saw a lot of recommendations on this sub for FreeTaxUsa and I was worried at first. Several states also provide tax relief for renters who dont meet age or disability criteria. Yes California has a renters credit.

To claim the CA renters credit. Neither you nor your spouse if married was granted a homeowners property tax exemption during 2021. You can still qualify for the credit even.

To qualify for the CA renters. Depending upon the CA main form used the output will appear on Line 46 of the Form 540 or Line 19 of Form 540 2EZ. Renters Credit on TurboTax.

You paid rent for a minimum of six months for your principal residence. To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly. California has signed the Golden State Stimulus which includes 600-1200 cash payments to eligible residents.

Posted by 1 year ago. Go to Screen 53 Other Credits and select California Other Credits. 1 Best answer.

Hawaii renters who make less than 30000 per year and pay at least 1000 in rent for their. I lived on a off-campus apartment and my name is on a lease so I do pay rent. File your income tax return.

You rented property for more than half the year that was not exempt from California property tax in 2021. Renters Credit on TurboTax Did you pay rent for at least half of 2019 on property in California that was your principal residence is what they asked. 120 credit if your are.

Turbotax Irs Launch Online Portal For Stimulus Check Direct Deposit

Intuit Turbotax And Other For Profit Tax Prep Companies Lead Americans To Pay For Their Stimulus Checks

What Is The Best Tax Software 2022 Winners

Turbotax Review 2022 Pros And Cons

Irs Form 540 California Resident Income Tax Return

Low Income Georgia Renters Could Receive Tax Credit Under New Proposal The Georgia Virtue

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Credit Cards Offering Tax Service Saving Rewards In 2022 Nextadvisor With Time

How To File Taxes For Free In 2022 Money

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

11 States That Give Renters A Tax Credit

What Are Tax Credits Turbotax Tax Tips Videos

Am I Eligible For A State Renter S Tax Credit

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Turbotax Irs Launch Online Portal For Stimulus Check Direct Deposit

If You Re Paying Rent In California You Could Be Eligible For Renter S Credit When Filing California Taxes R Frugal